Local Providers

We can Determine the top Payroll solutions in Luxemburg locally for you

Global Providers

Expand your business & relocate employees to Luxemburg using top global

PEO / EOR providers

Overview

Euros (EUR)

CURRENCY

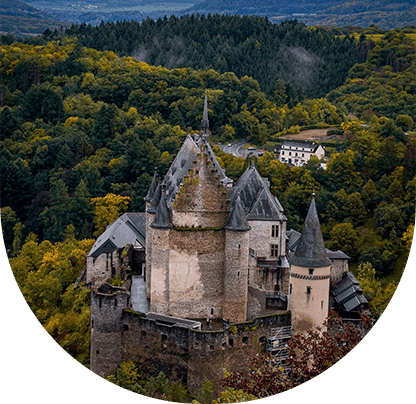

Luxemburg

CAPITAL

monthly

PAYROLL FRECUENCY

11

PUBLIC HOLIDAYS

12.22 to 15.30

EMPLOYER TAXES

13TH / 14TH SALARY

The 13th Salary in this region is usual and typically given at the end of the year.

Employee and employeer taxation in Luxemburg

Employer

Company Payroll Contributions

8% - 8%

Pension (this is up to a maximum of 11,284.77 EUR monthly)

2.80% - 3.05%

Health Insurance up to a maximum of 11,284.77 EUR per month)

0.68% - 1.13%

Work Accident up to a maximum of 11,284.77 EUR per month)

0.60% - 2.98%

Mutual Health up to a maximum of 11,284.77 EUR per month)

0.14% - 0.14%

Health at Work. This is up to a maximum of 11,284.77 EUR per month)

12.22% - 15.3%

Total Employment Cost

Employee

Worker Payroll Contributions

**

8%- 8%

Pension (this is up to a maximum of 11,284.77 EUR monthly)

2.80%- 3.05%

Health Insurance. This is up to a maximum of 11,284.77 EUR per month

1.40%- 1.40%

Dependency Contribution

12.2% - 12.45%

Total Employee Cost

Employee Income Tax in Luxemburg

Employment Income Taxes

1) Single Taxpayer (Class 1)

- 921 EUR: up to 20,000.00 EUR

- 5,317 EUR: between 20,001 EUR and 38,700 EUR

- 13,081 EUR: between 38,701 EUR and 58,000 EUR

- 21,177 EUR: between 58,001 EUR and 77,400 EUR

- 29,231 EUR: between 77,401 EUR and 96,700 EUR

- 37,456 EUR: between 96,701 EUR and 116,000 EUR

- 45,802 EUR: between 116,001 EUR and 135,500 EUR

- 54,242 EUR: between 135,501 EUR and 155,000 EUR

- 76,642 EUR: up to 205,000 EUR

Employee Income Tax

1) Single Taxpayer (Class 1a)

- 0 EUR: up to 20,000.00 EUR

- 4,271 EUR: between 20,001 EUR and 38,700 EUR

- 12,325 EUR: between 38,701 EUR and 58,000 EUR

- 20,420 EUR: between 58,001 EUR and 77,400 EUR

- 28,474 EUR: between 77,401 EUR and 96,700 EU

- 36,699 EUR: between 96,701 EUR and 116,000 EUR

- 45,045 EUR: between 116,001 EUR and 135,500 EUR

- 53,486 EUR: between 135,501 EUR and 155,000 EUR

- 75,885 EUR: up to 205,000 EUR

Single Taxpayer (Class 2)

- 0 EUR: up to 20,000.00 EUR

- 1,675 EUR: between 20,001 EUR and 38,700 EUR

- 5,113 EUR: between 38,701 EUR and 58,000 EUR

- 10,635 EUR: between 58,001 EUR and 77,400 EUR

- 18,110 EUR: between 77,401 EUR and 96,700 EUR

- 26,164 EUR: between 96,701 EUR and 116,000 EUR

- 34,302 EUR: between 116,001 EUR and 135,500 EUR

- 42,439 EUR: between 135,501 EUR and 155,000 EUR

- 63,357 EUR: up to 205,000 EUR

*These tax rates include a solidarity tax of 7.00% of taxes. In this case, it is 9.00% for taxpayers who earn more than EUR 150,000 in the 1st and 1st tax class. It is also for those who earn more than EUR 300,000 in tax class 2.

Minimum Wage in Luxemburg

General

Pay the monthly minimum wage in Luxembourg with payroll outsourcing services, which depends on whether you are a skilled or unskilled worker.

- For skilled workers over the age of 18, the gross minimum wage is EUR 2,776.05.

- For unskilled workers over the age of 18, the gross minimum wage is EUR 2,313.38.

- Employees between the ages of 17 and 18 receive a gross minimum wage of EUR 1,850.70.

- Employees between the ages of 15 and 17 receive a gross minimum salary of EUR 1,735.03.

$2663 Minimum Wage per month

Payroll Contributions in Luxemburg

Payroll Cycle

With payroll outsourcing in Luxembourg, you can comply with the monthly payment cycle, although some companies pay weekly. Also, the employer must pay on the last day of the month/week for monthly/weekly jobs.

13th Salary

As in other countries, in Luxembourg employers are customary to pay the thirteenth salary. In this case, it is a payment equivalent to one month of salary, paid at the end of the year. Also, most employers pay an additional half month of salary.

Employee Benefit in Luxemburg

Visa and work permit in Luxemburg

In Luxembourg, citizens of EU and EEA countries and Switzerland do not need a work visa. However, Croatian citizens need a work permit for their first year in the country. Therefore, contractor management services can help you obtain visas for foreign workers.

Thus, people who need to stay in the country for more than 90 days must go to the local Municipal Office in Luxembourg. Thus, they will have to declare their arrival and intention to stay in the country, during the first week of their arrival. Likewise, they must provide a certificate of domicile registration.

Besides, all foreigners who wish to stay more than 90 days to work in the country need a work visa.

Furthermore, employers in Luxembourg have to have passed the compulsory labor market test. Likewise, before publishing the vacancy, the employer must present it to the National Employment Agency (ADEM). Thus, if after 2 months no EU national has occupied the position, the employer may extend the offer to other foreigners.

However, the employer does not have to go through the market test if they want to hire a highly qualified employee. However, if you must declare the vacant position in the ADEM. In addition, the employee must have a contract signed for more than one year and demonstrate the qualification and the necessary academic training. Additionally, the salary must be 1.5 times the average gross annual salary or 1.2 times for certain professions.

Additionally, for foreigners to receive a work visa, they need a job offer from a local employer before entering the country. Likewise, the contract or offer must be under Luxembourg labor law, an essential requirement for approval. In this way, if the employment relationship between the parties ends, the visa also loses its validity.

VAT in Luxemburg

VAT in Luxembourg is 17.00%.

Working Hours in Luxemburg

General

Employees in Luxembourg must work a schedule of 8 hours per day and 40 hours per week.

Overtime

The Employer of Record in Luxembourg can manage these extra hours, which are those that exceed the standard weekly working hours. In addition, employment contracts or collective agreements are the ones that regulate these hours. In addition, both parties must agree to these overtime hours and must notify the labor authorities before starting them.

Likewise, there are limits on overtime, which must not be more than 2 hours per day or 8 hours per week. In addition, the employer must pay overtime at a rate of 150% of the worker's regular salary.

On the other hand, in Luxembourg employees must not work on Sunday, except in certain situations or specific sectors. Additionally, the employer must pay a specific amount.

Working Week

Monday to Friday.

Employee Termination in Luxemburg

Termination Process

The Employer of Record services in Luxembourg allows you to perform employee onboarding but also termination. Thus, this last process depends on how the Employment Contract and the Collective Agreement are in force. In addition, it is determined by the type of contract and the reason for termination.

Employers with more than 150 employees must hold a hearing before terminating an employee. In contrast, in companies with at least 15 employees, the employer must notify the economic committee of the dismissal.

Notice Period

Provisions relating to notice periods may exist in collective agreements. In addition, if these provisions differ from those established by law, the collective agreements prevail. Likewise, the notice period depends on the duration of the service as follows:

- 2 months of notice for employees with less than 5 years of service.

- 4 months of notice for employees with between 5 and 10 years of service.

- 6 months of notice for employees with more than 10 years of service.

However, an employer may pay the employee instead of the notice period.

Severance Pay

The international PEO will inform you about the provisions on the amount and calculation of compensation, which may be established by collective agreements. In addition, if this differs from what is established in the law, both parties must observe the process in the collective agreement. Below, you can see the amount of compensation according to the duration of employment:

- Less than five years of service. No severance pay

- 5-10 years of service. The employee receives 4 months of severance or the employer can extend the notice period by 5 months if it has less than 20 employees.

- 10-15 years of service. The worker receives 2 months of compensation or the employer can extend the notice to 8 months if it has less than 20 employees.

- 15-20 years of service. The employee receives 3 months of compensation or the employer can extend the notice by 9 months if it has less than 20 employees.

- 20-25 years of service. The employee receives 6 months of compensation or the employer can extend the notice to 12 months if it has less than 20 employees.

- 25-30 years of service. The employee receives 9 months of severance or the employer can extend the notice by 15 months.

- More than 30 years of service. The employee receives 12 months of severance or the employer can extend the notice by 18 months.

Probation Period

You will be able to hire and onboard workers in Luxembourg after the trial period, which is a minimum of 2 weeks. In addition, this period depends on the salary and qualifications of the employee as follows:

For employees who receive a salary of at least 4,586.12 EUR, the maximum probationary period is 1 year.

Employees with a professional skills certificate or equivalent must pass a probationary period of a maximum of 6 months.

Employees without a professional skills certificate or equivalent must pass a probationary period of a maximum of 3 months.

Employee Leaves in Luxemburg

Paid Time Offs

Manage paid time off through the Employer of Record in Luxembourg, which is 26 working days of paid vacation per year. Additionally, some workers receive additional leave automatically as follows:

People with disabilities or who suffered a work accident receive an additional 6 days of leave.

Luxembourg employees who work in mines receive an additional 3 days of leave.

An employee or apprentice who did not receive a continuous 44-hour week receives 1 additional day of leave. In this case, you must receive the additional day for every 8 weeks in which you did not receive the rest.

In the same way, collective agreements or employers can give extra paid vacation days.

Public Holidays

There are 11 national holidays throughout the year.

Vacation Holidays

There are 26 vacation holidays throughout the year.

Sick Days

Sick leave consists of a maximum of 26 weeks, which you can properly grant with an Employer of Record in Luxembourg. Also, an employee does not need to provide a medical certificate for a 1 or 2-day illness.

In this case, employees must receive 100.00% of the regular salary payment and benefits up to a certain limit. However, the employee can only enjoy these benefits until the end of the calendar month in which the 77th calendar day of the leave falls. However, in 18 months, the employee receives 11 weeks of fully paid leave. In addition, the employer must add to this the number of days remaining between the 77th day of absence and the end of the month.

Paternity Leave

Also, you can manage the paternity leave through an Employer of record in Luxembourg. The collective agreement or work contract establishes this leave, which is generally 10 days. However, the worker must notify his intention to take leave at least 2 months before.

Hence, if the employee does not notify the employer in that period, the latter may reduce the leave to only 2 days. In addition, the employee does not need to take the leave continuously and can take it within two months after the birth of the child.

Paternal Leave

The Employer of Record in Luxembourg can manage parental leave, which depends on the type of contract and the hours worked by the employee. However, for the worker to receive leave, he must be registered with social security at the time of birth/adoption. In addition, the registration must have at least 12 continuous months and work a minimum of 10 hours per week.

However, the employer does not pay for this leave but the Children's Future Fund grants an allocation. Additionally, this license only applies once per child and before the child turns 6 or 12 for adopted children. Also, the employee can use the leave totally, partially, or divided with the other parent.

The number of hours in the contract of the employee/collective agreement is the basis for the leave as follows:

- An employee working 40 hours per week at full-time. In this case, you receive 4-6 months full-time or 8-12 months part-time (50% of regular work hours). You may also receive 4 periods of 1-month leave within 20 months or 1-2 half days of leave per week within 20 months.

- The part-time worker who works at least 20 hours per week. They receive 4-6 months of full-time leave or 8-12 months of part-time leave (50% of regular hours).

- A part-time employee working at least 10 hours per week. In this case, you will receive 4 to 6 months of full-time leave.

- Salaried employees. These must have worked at least 10 hours per week.

Other Leave

Salaried employees who must leave work for personal reasons may receive the special leave. In this way, they can receive it at the time of the event, and cannot be transferred to the worker's ordinary license. In addition, there must be an agreement between the worker and the employer before any license is obtained.

Global employment outsourcing is useful to manage this leave depending on the reason (birth, marriage, death, and more).

Maternity Leave in Luxemburg

You can manage payments and maternity leave in Luxembourg with the PEO international services. In this case, the maternity leave is 20 weeks, which can begin 8 weeks before the expected date of delivery. However, the compulsory health insurance must have covered the employee for at least 6 months in the last year before the leave.

Similarly, the employee must notify her employer at least 12 weeks before the expected delivery date. In addition, Social Security is the one that pays for the leave that must be between the minimum wage and 5 times that salary.

There are 140 leave throughout the year.

Take your company to the next level with our support