Local Providers

We can Determine the top Payroll solutions in French Guiana locally for you

Global Providers

Expand your business & relocate employees to French Guiana using top global

PEO / EOR providers

Overview

Euro (EUR)

CURRENCY

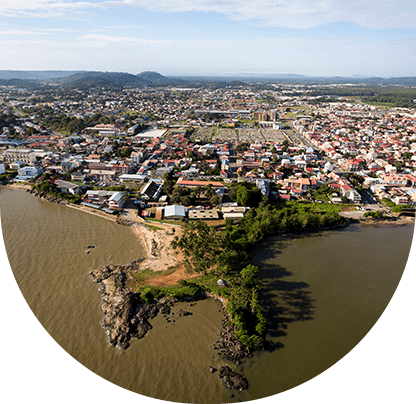

Cayenne

CAPITAL

monthly

PAYROLL FRECUENCY

12

PUBLIC HOLIDAYS

0 to 0

EMPLOYER TAXES

13TH / 14TH SALARY

The 13th Salary in this region is usual and typically given at the end of the year.

Employee and employeer taxation in French Guiana

Employer

This region follows French payroll contributions laws.

Employee

This region follows French employee payroll contributions laws.

- 0%

Total Employee Cost

Employee Income Tax in French Guiana

Employee Income Tax

0%

For wages of up to EUR 9,700

14%

For wages between EUR 9,711 and EUR 26,818

30%

For wages between EUR 26,818 and EUR 71,898

41%

For wages between EUR 71,898 and EUR 152,260

45%

For wages over EUR 152,260

Minimum Wage in French Guiana

Payroll Contributions in French Guiana

Payroll Cycle

The frequency of the payroll cycle in French Guiana is monthly. On the other hand, you can easily process your payroll if you request payroll outsourcing services from an Employer of Record. Besides, getting HR and payroll outsourcing solutions can bring your company many benefits in the short and long term.

13th Salary

In French Guiana, the 13th or 14th month’s salary is regulated under the rules of France. And if you hire an Employer of Record in French Guiana, you can find out further information about this topic. Furthermore, requesting payroll outsourcing solutions and PEO services can also help you manage this employee payment.

Employee Benefit in French Guiana

- Annual leave.

- Social Security benefits.

- Public holidays.

- Healthcare.

- Old-age pension.

- Elderly solidarity allowance.

- Short-term and long-term disability pension.

- Spouse’s pension.

- Retirement benefits.

- Workers’ compensations.

Visa and work permit in French Guiana

EU nationals, US nationals, Canadian nationals, Australian nationals, and British nationals do not need a visa to enter French Guiana. More precisely, they do not need a visa to stay for up to 90 days as long as they have a return ticket. Nonetheless, all visitors to French Guiana (or foreigners passing through the country) must have a valid yellow fever vaccination certificate.

If a national who requires a visa wants to enter French Guiana, they can only do it on a Schengen Visa if it is marked on the visa sticker.

On the other hand, if an EU national is staying longer than 3 months, they must register at the prefecture to obtain a Carte de séjour (French residence permit). As for other nationals, they will need to apply for a long-stay visa. However, to obtain more details, individuals must contact the embassy in their home country. A Professional Employment Organization or Employer of Record in French Guiana can also provide you with further details.

VAT in French Guiana

In French Guiana, there is no local VAT system. Nonetheless, there is a Consumption Tax known as “dock dues”. And this tax is on products imported from outside the DOMs (Overseas France or France D’Outre-Mer). Furthermore, the authorities also apply this tax to certain locally manufactured products. Besides, just like the VAT in other countries, this consumption tax is collected by businesses. Then, it is eventually funded completely by the end buyer.

Currently, the standard rate of this consumption tax in French Guiana is 20%. However, there are also two discounted rates. Firstly, there is a discounted rate of 10% (for books, local public transit, restaurant meals, and hotel stays). Secondly, the other discounted rate is 5.50% (for most groceries). Furthermore, there is also a third surcharge rate of 2.10% (for prescription medicines insured by Social Security). On the other hand, you can hire an EOR or PEO in French Guiana to find more accurate information about this tax.

Working Hours in French Guiana

General

The standard workweek in French Guiana consists of 35 hours in all types of businesses or industries. Besides, there is also a maximum number of weekly working hours, which is 48 hours. However, employers cannot require their employees to work more than 44 hours over a 12-week period. But a contractual or collective bargaining agreement may allow for an increase in the 12-week average to 46 hours a week.

On the other hand, a working day must not exceed 10 hours. Nonetheless, there can be an extension to 12 hours if a contractual or collective bargaining agreement allows it. However, note that there is an exemption from these restrictions for certain executives and white-collar workers.

Apart from this, employees who work more than 35 hours a week must be compensated for every additional hour. And usually, employers compensate their employees with additional vacation time.

As a matter of fact, the standard French workday is longer than in other countries due to the mid-day break. Typically, it begins between 8 am and 9 am, and ends at 6 pm or later. Besides, there is an hour-long (or longer) break between 12:30 pm and 2 pm.

Furthermore, employees in French Guiana have to take at least 35 continuous hours of rest over a 7-day period. Also, note that employees cannot work for more than 4.5 hours without a break.

Overtime

In French Guiana, overtime consists of a maximum of 220 hours per year. Plus, the workweek cannot be longer than 48 hours (including overtime). Besides, employers must compensate employees who work overtime on a percentage of income basis. However, collective bargaining agreements can establish a higher or lower rate of overtime in some cases.

In most cases, employers pay overtime as follows:

- 25% an hour for each of the first 8 hours of overtime. Besides, it must include from the 36th to the 43rd hour).

- 50% for each hour after that.

Working Week

Monday to Friday.

Employee Termination in French Guiana

Termination Process

In French Guiana, an employment contract can be terminated either due to serious misbehavior of the employee or the employer. But it is subject to the appraisal of the pertinent court regarding the significance of the misbehavior.

On the other hand, the employee must receive a notice period before the termination of the contract. Besides, during this period, the employee may take one day of authorized and fully paid leave per week to seek another job. However, the employee is the one who decides whether to use this leave entirely or not.

Furthermore, both parties must respect all the reciprocal obligations incumbent upon them during the notice period.

Notice Period

The notice period in French Guiana can vary depending on the worker’s length of employment. For instance, if the employee served between 6 months and 2 years, they must receive a one-month notice period. But if they served for more than 2 years, they shall receive a two-month notice.

On the other hand, collective agreements or company practices can set the notice period in certain cases. For example, this is the case for employees who served for up to 6 months.

Severance Pay

Just like the notice period, the employees’ severance pay will depend on their length of employment. But in this case, it will also depend on the relevant CBA’s provisions. Generally, employers calculate severance pay on the basis of an employee’s regular salary during the last 12 months of employment. Besides, this calculation usually includes bonuses as well as basic salary.

In French Guiana, employees receive one-fourth of their monthly salary for each year of service as statutory severance pay. Nonetheless, this is only the case for the employee’s first 10 years of employment. Then, they shall receive one-third of their monthly salary for each year above 10 years of service. This scheme is applicable when no CBA applies or the CBA rate is significantly lower than the statutory amount.

On the other hand, if their rate is higher than that of the CBA or the statutory amount, employment contracts may also provide for severance payments. But in order to calculate severance pay, we suggest you hire an Employer of Record in French Guiana.

Probation Period

In French Guiana, the probation period can range between 2 and 4 months, depending on the type of job. For instance, blue-collar and white-collar employees will have a probationary period of 2 months. On the other hand, supervisors and technical employees will have a probationary period of 3 months. Lastly, managers and professional staff will have a probationary period of 4 months.

Employee Leaves in French Guiana

Paid Time Offs

Employees who have served for at least 12 consecutive months with the same employer can take annual. And according to French Guiana’s employment laws, this type of leave usually consists of at least 30 days or 5 weeks.

Public Holidays

There are 12 national holidays throughout the year.

Vacation Holidays

There are 30 vacation holidays throughout the year.

Sick Days

Workers in French Guiana are eligible for a maximum of 6 months of sick leave. Make sure to contact an Employer of Record in French Guiana to get further information about this employee benefit.

Paternity Leave

If an employee becomes a father, they can take paternity leave. However, in the case of normal childbirth, they will only be able to take 25 days. But if it is multiple births, they can take up to 32 days of paternity leave.

Paternal Leave

There are no provisions for parental leave in French Guiana.

Other Leave

There are no other types of leave in French Guiana.

Maternity Leave in French Guiana

In French Guiana, female employees who are expecting a child can take 16 weeks of maternity leave. Firstly, they can take 6 weeks of leave before the expected childbirth day. Then, they can take the remaining 10 weeks after delivery.

There are 112 leave throughout the year.

Take your company to the next level with our support