Local Providers

We can Determine the top Payroll solutions in Armenia locally for you

Global Providers

Expand your business & relocate employees to Armenia using top global

PEO / EOR providers

Overview

Armenian Dram (AMD)

CURRENCY

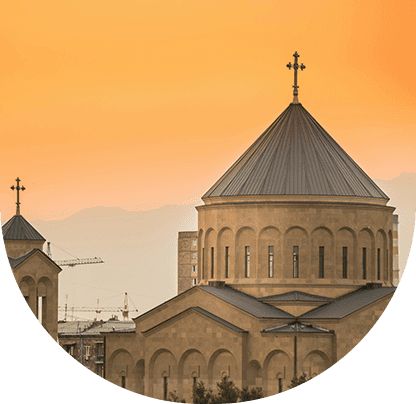

Yerevan

CAPITAL

monthly

PAYROLL FRECUENCY

16

PUBLIC HOLIDAYS

0.00 to 0

EMPLOYER TAXES

13TH / 14TH SALARY

The 13th Salary in this region is usual and typically given at the end of the year.

Employee and employeer taxation in Armenia

Employer

Employer Payroll Contributions

00.00% - 0%

0% - 0%

Total Employment Cost

Employee

Employee Payroll Contributions

4.50%

Pension fund – this is in case the monthly gross income is less than 500,000 AMD

0%- 10.00%

In case the monthly income is >500,000 AMD monthly, there is a 10.00% pension payment. This payment does not exceed 27,500 AMD

4.5% - 10%

Total Employee Cost

Employee Income Tax in Armenia

Military Taxes:

- For salaries of no more than 100,000 AMD: 1,500 AMD

- For salaries between 100,000 - 200,000 AMD: 3,000 AMD

- for salaries between 200,000 - 500,000 AMD: 5,500 AMD

- For salaries between 500,000 - 1,000,000 AMD: 8,500 AMD

- For salaries of more than 1,000,000 AMD: 15,000 AMD

21.00%

Flat Rate

Minimum Wage in Armenia

General

In Armenia, the National Monthly Minimum Wage is 68,000 AMD. And here, the Minimum Hourly Wage is 406 AMD. Plus, those employees who work in dangerous/hazardous environments can earn a premium over their average salary. With an Employer of Record, you can learn more about the statutory minimum wage in Armenia.

$140 Minimum Wage per month

Payroll Contributions in Armenia

Payroll Cycle

In Armenia, the payroll cycle is generally completed on a monthly basis. And employers must pay wages on the 15th day of the following month. With an Employer of Record in Armenia, companies can obtain efficient payroll outsourcing services to pay their employees promptly.

13th Salary

Unlike in other countries, the 13th salary payment is not mandatory in Armenia. And by obtaining international PEO services, you can learn more about this particular topic.

Employee Benefit in Armenia

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

Visa and work permit in Armenia

All individuals who desire to enter Armenia for business purposes must apply for a work permit. And this permit must be sponsored by their employer to legally work in Armenia.

Usually, holders of Armenian visas are not allowed to work in the country unless they are also work permit holders.

Nonetheless, some individuals are exempt from the work permit requirement, including highly-skilled specialists, business owners, executives, and other workers. And unless a foreign individual is exempt from this requirement, the employer must obtain a work permit before the employee starts their employment period.

The Ministry of Labor and Social Affairs (MLSA) is the authority that issues work permits in Armenia. And this entity is also in charge of testing the Armenian market to ensure that there are no available and qualified Armenian workers to fill that position internally. Once the foreign national receives their work permit, they can start working. But note that this permit has a fixed term and can be renewed on request.

After the foreign national obtains their work permit, they must file an application for a temporary residence permit. And they can apply for it at the Passport and Visa Department of the Police in Yerevan. During the application, the individual must provide the required supporting documents (including medical tests). Furthermore, note that the issuance of the residence card may take between 30 and 45 days from the application date.

Certain individuals, such as those who enter on a contractual basis, may qualify for temporary residence in Armenia. In addition, international students, researchers, and journalists may also qualify for it. However, note that this temporary residence is valid for one year, but it can be extended for one additional year.

VAT in Armenia

In Armenia, the general rate of VAT is 20%. Performing your employer duties with a PEO or Contractor Management Services makes everything more efficient. And with them, running a company in Armenia becomes an easy task.

Working Hours in Armenia

General

The Labour Law or RA Labor Code of Armenia states that the standard working hours of Armenian employees should not exceed 40 hours a week. Furthermore, a daily work period should not exceed 8 working hours either. Plus, the maximum working time must not exceed 12 hours per day (48 hours per week). And note that this includes overtime and breaks.

Overtime

Employers in Armenia must calculate overtime at 150% of the standard hourly rate for each hour of overtime worked.

Besides, there is another overtime calculation in case Armenian workers have to work at night. And in that case, employers must calculate it at 130% of the standard hourly rate for each hour of night work. The most effective way to calculate overtime is by requesting the services of an Employer of Record in Armenia.

Working Week

Monday to Friday.

Employee Termination in Armenia

Termination Process

In order to terminate an employee, employers in Armenia must have a valid reason and provide notice before proceeding. And generally, the notice period is linked to the worker’s length of employment within the company.

Notice Period

In Armenia, the notice periods are calculated as per the worker’s employment length as follows:

- The employee served for less than 1 year: 14 days’ notice

- The employee served between 1 and 5 years: 35 days’ notice

- The employee served between 5 and 10 years: 42 days’ notice

- The employee served more than 10 years: 60 days’ notice

Severance Pay

Depending on the reason for termination, and should it be company related, the severance pay can be determined. For example, valid reasons can be the liquidation of the company or the reduction of the number of employees. And in any case, the severance pay should be equal to the employee’s average monthly salary.

- The employee served for less than 12 months: 10 times their average daily salary

- The employee served between 1 and 5 years: 25 times their average daily salary

- The employee served between 5 and 10 years: 30 times their average daily salary

- The employee served between 10 and 15 years: 35 times their average daily salary

- The employee served for more than 15 years: 44 times their average daily salary

Probation Period

Generally, probation periods in Armenia consist of 3 months, and the employees’ contracts of employment will determine these periods. But in case either the employee or employer desires to terminate before this period, they can terminate the contract with 3 days’ notice.

Employee Leaves in Armenia

Paid Time Offs

In Armenia, employers calculate the minimum days of paid annual leave that employees can get based on their working week. For example, if an employee works 5 days per week, they will receive 20 days of annual leave. But if an employee works 6 days per week, then they will be entitled to 24 days of annual leave.

And the number of days of annual leave can increase if Armenian employees work under stressful or high-risk conditions. For instance, employees working a 5-day working week may receive an annual leave entitlement of up to 35 days. But this can only happen in exceptional conditions. On the other hand, employees working a 6-day working week can receive up to 42 days in extraordinary circumstances.

In Armenia, employees usually access annual leave after continuously working for at least 6 months.

Public Holidays

There are 16 national holidays throughout the year.

Vacation Holidays

There are 20 vacation holidays throughout the year.

Sick Days

If an employee gets sick, the employer must provide paid sick leave from day 2 to day 5. And this means that on the first day, the employee receives unpaid leave. However, if the employee remains sick for 6 or more days, Social Insurance will cover the paid sick leave. The employee will remain entitled to their full benefits if they are absent for less than 120 successive days or 140 days within a year.

On the other hand, The Social Insurance Scheme is in charge of paying an employee’s sick leave under certain conditions. If the employee’s absence is due to work-related injury/illness, Social Insurance will proceed to pay the sick leave. And once the employee recovers and feels healthy enough, they may return to work. The best way to calculate paid leave is by using the services of an Employer of Record in Armenia.

Paternity Leave

Those employees in Armenia who are New Fathers can receive up to 5 days of paid leave within the first 30 days of their child’s birth.

Paternal Leave

Employees can request up to 5 days of paid parental leave within the first month of their child’s birth. To calculate of types of paid leave, companies should request the services of a reputable Employer of Record in Armenia. And payroll outsourcing can be the best solution as well.

Other Leave

Bereavement Leave: In the event of the death of a family member, employers must provide their employees with 3 days of unpaid leave to attend the funeral.

Marriage Leave: In the event of their marriage, employees can receive 3 days of unpaid leave.

Maternity Leave in Armenia

Female employees in Armenia are entitled to a minimum of 140 days of maternity leave. And it usually consists of 70 days during pregnancy and the remaining 70 days following the child’s birth. But in the case of complicated childbirth, the maternity leave can be increased to 155 days (70 days during pregnancy and 85 days during childbirth). And in the case of multiple births, the entitlement would increase to 180 days (70 days during pregnancy and 110 days during childbirth).

Furthermore, employers in Armenia must provide paid maternity leave at 100% of the insured’s average monthly earnings divided by 30.4, which is the average number of days in a month. And the employer must take into account the insured’s average monthly earnings regardless of the number of years of covered employment. If you desire to calculate it accurately, try using the services of an Employer of Record in Armenia.

There are 140 leave throughout the year.

Take your company to the next level with our support